Actions

Une gestion actions de conviction mise en œuvre par une équipe de gérants/spécialistes qui intègrent les enjeux environnementaux, sociaux et de gouvernance.

convictions

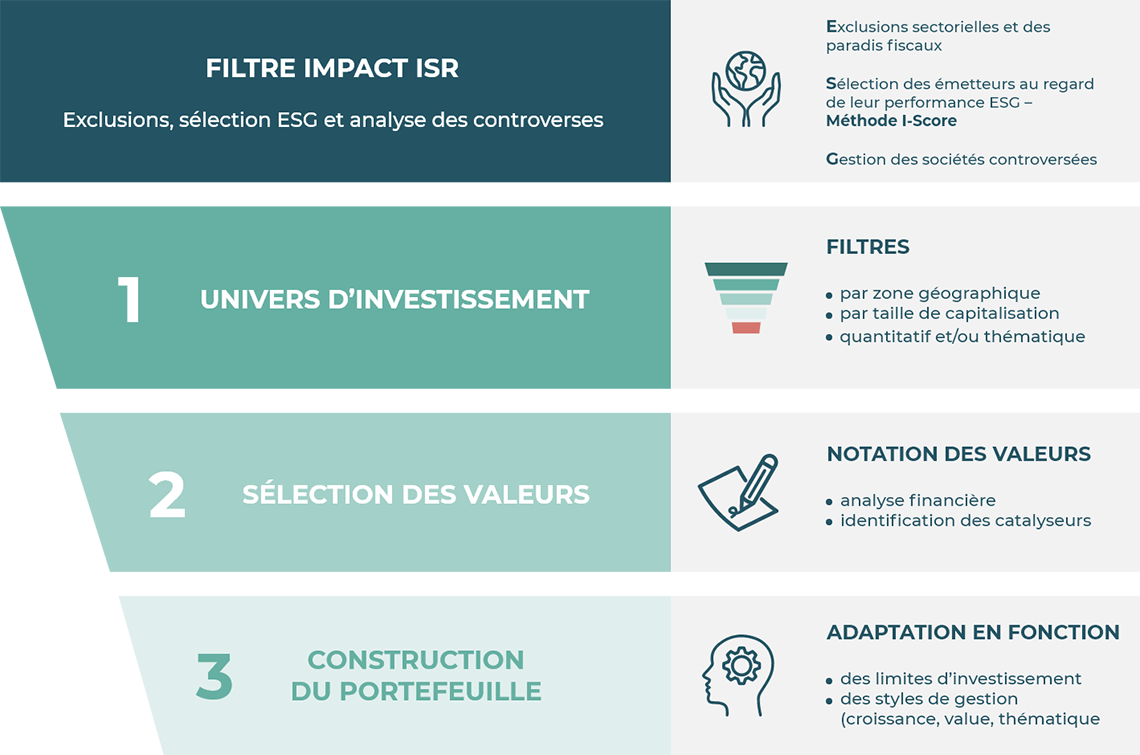

La philosophie d’investissement actions est le résultat d’une approche fondamentale pour la sélection de titres « bottom-up », étayée par une réflexion macro-économique « top down ».

La connaissance des sociétés, l’analyse financière et extra-financière sont au cœur du processus d’investissement.

- PROCESSUS DE GESTION

-

La gestion actions est une gestion de conviction. Elle s‘appuie sur un comité de revue des sociétés (analyse, rentabilité, risque) et un comité de gestion pour le suivi opérationnel des portefeuilles

- SPÉCIFICITÉS

-

Le processus d’investissement est décliné selon une pluralité de stratégies et de styles de gestion, combinant l’analyse financière et extra-financière.

Nos principales thématiques d’investissement sont ancrées sur le long terme, aussi bien en zone Euro qu’à l’international, et concernent toutes les capitalisations, pour une finance soutenable :

- croissance durable ;

- cash-flow récurrent.

NOS FONDS ACTIONS 100% ISR*

| Nom | Descriptif | Risque (SRI) | Horizon de placement |

|---|---|---|---|

Pour investir sur le marché américain |

5 | 5 ans | |

Pour investir sur les pépites de demain et bénéficier du potentiel de développement des petites et moyennes capitalisations |

4 | 5 ans | |

Pour investir dans les actions génératrices de cash-flow |

5 | 5 ans | |

Pour profiter des actions qui générent des revenus réguliers |

5 | 5 ans | |

Pour conduire l’avenir et investir sur 6 thématiques liées à l’Homme et à son environnement |

4 | 5 ans | |

Pour investir sur les marchés actions en pilotant les risques |

4 | 5 ans | |

Pour donner du sens au progrès et financer les entreprises investies dans les enjeux du développement durable |

4 | 5 ans | |

Pour une gestion privilégiant une sélection statistique de valeurs aux performances régulières proches de l’indice de référence de la zone Euro |

5 | 5 ans |

Les chiffres cités ont trait aux années écoulées et les performances passées ne sont pas un indicateur fiable des performances futures.

(*) 100% ISR selon la méthodologie d’ECOFI (hormis un fonds indexé). 12 OPC ont aussi obtenu le Label ISR d’Etat.

Risque de perte en capital, actions, de taux, de change et de contrepartie, de gestion discrétionnaire.

Nos expertises

Ensemble, nous bâtissons des solutions d'investissements alliant performances financières et respect de l'Homme et de la Planète. Actifs pour le futur, nous prenons les devants pour façonner un avenir dont nous sommes tous responsables.

Le kiosque

A la une

Un fonds megatrend durable et ISR...

Karen Georges, gérante actions, est au micro de Olivier Samain, Directeur du Développement chez SELENCIA Patrimoine pour évoquer les spécificités d'Ecofi Enjeux Futurs.

Lancer la vidéo