MULTI-ACTIFS

L’agilité et la réactivité sont au cœur de notre gestion multi-actifs, avec une analyse intégrée des enjeux environnementaux, sociaux et de gouvernance.

convictions

La philosophie d’investissement multi-actifs est le résultat d’une approche fondamentale pour la sélection de titres « bottom-up », étayée par une réflexion macro-économique « top down ».

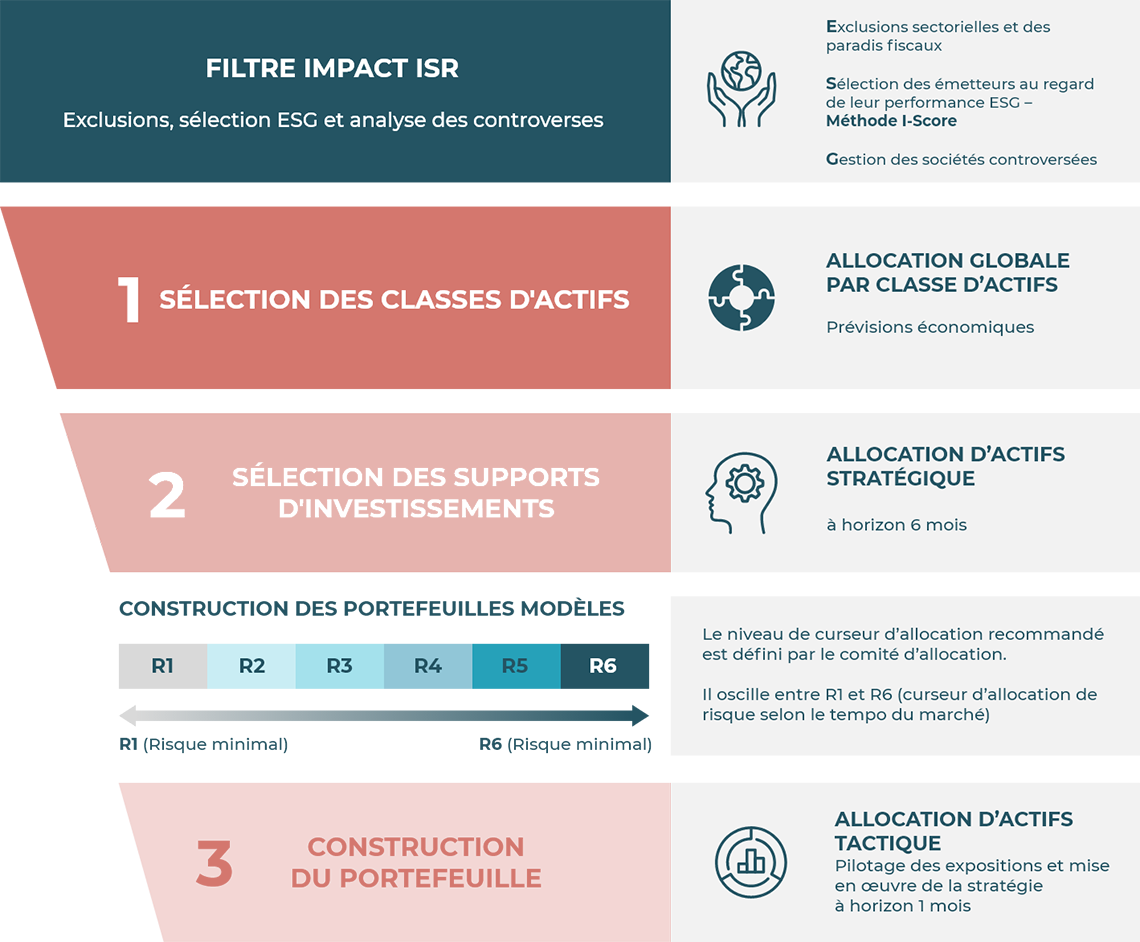

La stratégie d’investissement est fondée sur l’allocation d’actifs et la sélection des supports d’investissement. Notre recherche interne et nos outils propriétaires sont des forces pour :

- pondérer les actifs selon l’environnement de marché,

- saisir les opportunités avec réactivité,

- piloter le risque et obtenir le meilleur rendement possible.

- PROCESSUS DE GESTION

-

- SPÉCIFICITÉS

-

L’univers de gestion couvre l’ensemble des actifs éligibles à l’investissement dans les fonds, majoritairement provenant de la zone OCDE.

Les gérants spécialistes de l’allocation d ‘actifs s’appuient pour la réalisation des investissements sur les compétences de l’ensemble de l’équipe de gestion d’Ecofi. A des fins de diversification, les équipes peuvent sélectionner des supports externes (ETF, OPC).

Notre expertise comprend des fonds à dominante taux ou actions, flexibles et thématiques.

NOS FONDS MULTI-ACTIFS 100% ISR*

| Nom | Descriptif | Risque (SRI) | Horizon de placement |

|---|---|---|---|

Pour profiter d’une allocation tactique sur plusieurs classes d’actifs et diversifier les moteurs de performance |

2 | 2 ans | |

Pour contribuer au financement d’entreprises solidaires et profiter d’une solution multi-actifs à dominante taux |

3 | 2 ans | |

Pour financer la transition énergetique et écologique |

4 | 5 ans | |

Pour contribuer au financement d’entreprises solidaires et profiter d’une solution multi-actifs à dominante taux |

3 | 2 ans | |

Pour contribuer au financement d’entreprises solidaires et profiter d’une solution multi-actifs à dominante taux |

3 | 2 ans | |

Pour financer la transition énergetique et écologique |

4 | 5 ans | |

Pour profiter d’un fonds multi-actifs investi en obligations classiques et obligations convertibles |

2 | 3 ans | |

Pour benéficier d'une protection de capital au moins égale à 85% en fonction de la performance de l'indice "Euronext Climate Objective 50 Euro EW Décrement 5% |

2 | ||

Pour une allocation d’actifs mobile et réactive investie sur les grandes classes d’actifs |

3 | 3 ans | |

Pour profiter d’un fonds multi-actifs investi dans les émetteurs les plus responsables d’un point de vue ESG |

3 | 3 ans | |

Pour partager, avec ceux qui agissent |

3 | 3 ans | |

Pour financer la transition énergetique et écologique |

4 | 5 ans |

Les chiffres cités ont trait aux années écoulées et les performances passées ne sont pas un indicateur fiable des performances futures.

(*) 100% ISR selon la méthodologie d’ECOFI (hormis un fonds indexé). 12 OPC ont aussi obtenu le Label ISR d’Etat.

Risque de perte en capital, actions, de taux, de change et de contrepartie, de gestion discrétionnaire.